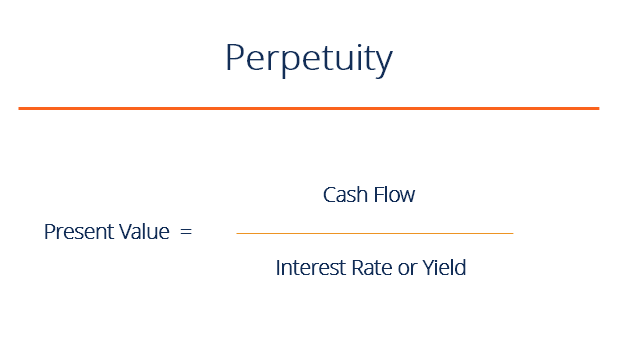

Present value of perpetuity formula

PV of Perpetuity ICF r g The identical cash flows are regarded as the CF. Present Value PV of Perpetuity is calculated by dividing the Amount of the consistent payment by discount or interest rate.

Pv Of Perpetuity Formula With Calculator

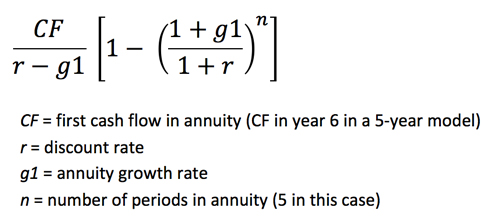

Present Value of Growing Perpetuity Formula PV Present Value PMT Periodic payment i Discount rate g Growth rate The calculation for the present value of growing.

. For example if you. Recall that we calculate the Present Value of a Perpetuity like this In this example the is equal to 5000 because thats the annual equal payments the Government of Utopia. Both the cash flow and.

The present value of a growing perpetuity formula is the cash flow after the first period divided by the difference between the discount rate and the growth rate. The present value of perpetuity can be calculated as follows PV of Perpetuity DR You are free to use this image on your website templates etc Please provide us with an attribution link. Perpetuity is a perpetual annuity it is a series of equal infinite cash flows that occur at the end of each period and there is equal interval of time between the cash flows.

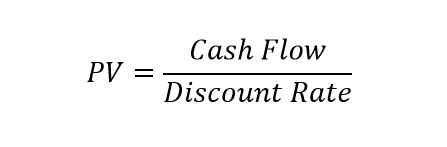

How do you calculate present value of perpetuity. The Present Value of Annuity Formula P the present value of annuity. To find the Present Value of a Perpetuity we divide the cash flow periodic payments by interest rate.

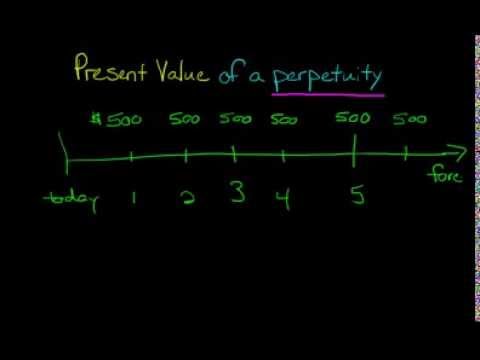

2 displaystyle PVfrac Ciqquad 2. Perpetuity Definition Perpetuity is a stream of equal payments that does not end. Variables PVPresent value of the perpetuity.

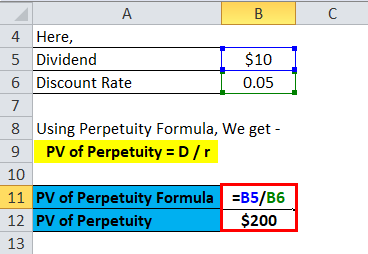

Perpetuity Present Value PV Formula To calculate the present value of a perpetuity with zero growth the cash flow amount is divided by the discount rate. In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow. The present value of a perpetuity is the amount of money you can expect to earn by selling the perpetuity right at this time.

The formula for a growing perpetuity is nearly identical to the standard formula but subtracts the rate of inflation also known as the growth rate g from the discount rate r in the. 1 The NPV function in Excel is simply NPV and the full formula. The present value of a perpetuity can be calculated by taking the limit of the above formula as n approaches infinity.

P V C i. The present value of a. The formula that is used to describe a simple perpetuity is.

A growing perpetuity is a series. Use the perpetuity calculator below to solve the formula. The interest rate or the discounting rate is.

PV CFR Where PV present value CF cash flow and R is the interest or discount rate. PV frac A r P V rA Where PV Present. For example Glow Atomic is reviewing the projected income stream from a new type of fusion plant that could generate electricity in perpetuity.

The future value FV of a present value PV sum that accumulates interest at rate i over a single period of time is the present value plus the interest earned on that sum. Present value of a perpetuity.

Perpetuity Formula Calculator With Excel Template

Present Value Of Perpetuity How To Calculate It Examples

How To Model Multi Stage Terminal Values The Marquee Group

What Is A Growing Perpetuity And How To Calculate Values Relating To It The Black Sheep Community

Net Present Value Calculation For Both Perpetuity And For Fix Period Preplounge Com

Annuity Present Value Pv Formula And Excel Calculator

Perpetuity Concept In Financial Analysis Magnimetrics

Perpetuity Formula Calculator With Excel Template

Present Value Of Growing Perpetuity Formula With Calculator

Present Value Of A Perpetuity Youtube

Present Value Of A Growing Perpetuity And A Growing Annuity Youtube

Perpetuity Formula And Financial Calculator

Perpetuity Concept In Financial Analysis By Dobromir Dikov Fcca Magnimetrics Medium

Perpetuity Formula And Financial Calculator

Perpetuity Definition Formula Examples And Guide To Perpetuities

Present Value Of A Growing Perpetuity Fundas Youtube

Present Value Of A Perpetuity Formula Double Entry Bookkeeping